Speaker Profile

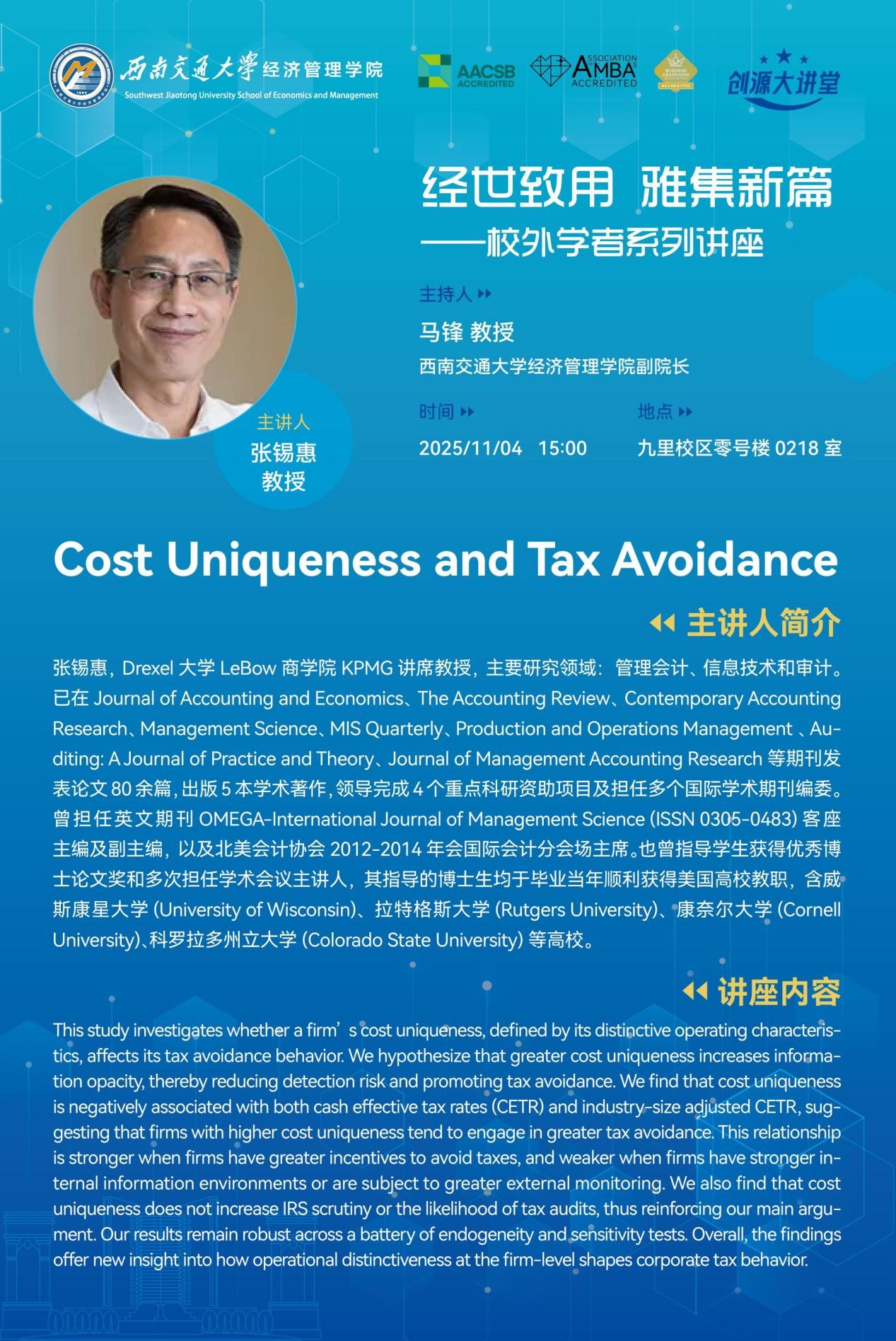

Dr. ZHANG Xihui is the KPMG Endowed Chair Professor at the LeBow College of Business, Drexel University. Her primary research interests lie in management accounting, information technology, and auditing.

He is a prolific scholar with over 80 articles published in premier academic journals, including Journal of Accounting and Economics, The Accounting Review, Contemporary Accounting Research, Management Science, MIS Quarterly, Production and Operations Management, Auditing: A Journal of Practice and Theory、Journal of Management Accounting Research. In addition, he has authored five academic books and has served as the principal investigator for four major funded research projects.

Professor Zhang's leadership in the academic community includes serving as a Guest Editor and an Associate Editor for OMEGA-The International Journal of Management Science, and as the Chair of the International Accounting Section for the American Accounting Association (AAA) Annual Meeting from 2012-2014. He also serves on the editorial boards of several international journals. As a dedicated mentor, his doctoral students have secured faculty positions at prominent universities such as University of Wisconsin, Rutgers University, Cornell University, and Colorado State University immediately upon graduation.

Abstract

This study investigates whether a firm’s cost uniqueness, defined by its distinctive operating characteristics, affects its tax avoidance behavior. We hypothesize that greater cost uniqueness increases information opacity, thereby reducing detection risk and promoting tax avoidance. We find that cost uniqueness is negatively associated with both cash effective tax rates (CETR) and industry-size adjusted CETR, suggesting that firms with higher cost uniqueness tend to engage in greater tax avoidance. This relationship is stronger when firms have greater incentives to avoid taxes, and weaker when firms have stronger internal information environments or are subject to greater external monitoring. We also find that cost uniqueness does not increase IRS scrutiny or the likelihood of tax audits, thus reinforcing our main argument. Our results remain robust across a battery of endogeneity and sensitivity tests. Overall, the findings offer new insight into how operational distinctiveness at the firm-level shapes corporate tax behavior.

Date/Time: November 4, 2025, 15:00 p.m.

Venue: Room 0218, 0 Teaching Building, Jiuliu Campus